Ibercaja Empresas: summative Financial Solutions for Businesses

Introduction

In today's competitive business landscape, companies require robust financial facilities to sustain growth, govern cash flow, and optimize operations. Ibercaja Empresas, the event banking estrangement of Ibercaja Banco, offers tailored financial solutions designed to meet the needs of small, medium, and large enterprises. taking into consideration a strong presence in Spain, Ibercaja provides a wide range of banking products, from loans and story lines to digital banking tools and investment instructive services.

This article explores the key offerings of Ibercaja empresas , including:

Business Financing Solutions

Digital Banking and Payment Services

International Trade and Foreign Exchange

Investment and Treasury Management

Insurance and Risk Management

Specialized sustain for SMEs and Startups

By union these services, matter owners can leverage Ibercajas achievement to augment financial stability and drive long-term success.

1. situation Financing Solutions

Access to capital is crucial for matter expansion, equipment purchases, and functional capital management. Ibercaja Empresas provides various financing options tailored to substitute issue needs.

A. business Loans and financial credit Lines

Term Loans: unconditional or amendable combination rate loans for long-term investments Ibercaja empresas such as property acquisition or business expansion.

Credit Lines: energetic financing for short-term liquidity needs, including overdraft facilities and revolving credit.

ICO Financing: Government-backed loans through the endorsed relation Institute (ICO) later appreciative terms for SMEs.

B. Leasing and Renting

Equipment Leasing: Financing for machinery, vehicles, and technology gone athletic repayment plans.

Real estate Leasing: Solutions for acquiring advertisement properties even if preserving liquidity.

C. Factoring and Confirming

Factoring: sudden liquidity by selling invoices to Ibercaja, improving cash flow.

Confirming: Supplier payment organization utility that optimizes payment terms and strengthens supplier relationships.

These financing solutions incite businesses preserve liquidity, invest in growth, and navigate economic fluctuations.

2. Digital Banking and Payment Services

In an increasingly digital economy, Ibercaja Empresas offers campaigner online banking tools to streamline financial operations.

A. Online and Mobile Banking

Business Net: A safe platform for managing accounts, transfers, payroll, and tax payments.

Mobile App: Real-time permission to banking services, including digital signatures and payment approvals.

B. Payment Solutions

POS Terminals: safe card payment systems for retail and hospitality businesses.

Direct Debits and Bulk Payments: Automated payment government for salaries, suppliers, and recurring expenses.

Bizum for Businesses: Instant P2P transfers for little transactions.

C. E-commerce Integration

Payment gateways for online stores.

Fraud prevention and cybersecurity measures.

These digital tools improve efficiency, edit administrative burdens, and augment financial control.

3. International Trade and Foreign Exchange

For businesses engaged in global trade, Ibercaja Empresas provides specialized facilities to encourage cross-border transactions.

A. Trade Finance

Letters of Credit: secure payment guarantees for international suppliers.

Export and Import Financing: Pre-shipment and post-shipment relation facilities.

B. Currency difference of opinion and Hedging

Competitive FX rates for EUR, USD, GBP, and additional major currencies.

Forward contracts and options to mitigate currency risk.

C. International Cash Management

Multi-currency accounts.

Global payment solutions (SWIFT, SEPA).

These facilities back up businesses expand internationally even if minimizing financial risks.

4. Investment and Treasury Management

Optimizing liquidity and returns is indispensable for situation sustainability. Ibercaja offers:

A. Treasury Management

Short-term investment products (deposits, keep present funds).

Liquidity supervision tools for maximizing cash reserves.

B. pension Plans and Employee Benefits

Corporate income schemes.

Tax-efficient savings plans for employees.

C. Investment Advisory

Portfolio giving out for surplus funds.

Market analysis and tailored investment strategies.

These facilities ensure businesses make informed financial decisions while maximizing returns.

5. Insurance and Risk Management

Protecting situation assets and operations is critical. Ibercaja provides:

A. business Insurance

Property and answerability insurance.

Cyber risk coverage.

B. Trade relation Insurance

Protection adjoining customer non-payment.

C. Key Person and Directors Insurance

Safeguarding against leadership risks.

Comprehensive insurance solutions minimize disruptions and financial losses.

6. Specialized preserve for SMEs and Startups

Ibercaja offers dedicated programs for small businesses and entrepreneurs:

Startup Financing: Seed capital and venture debt.

Business Advisory: Mentorship and networking opportunities.

Tax Incentives: instruction on regional and national subsidies.

Conclusion

Ibercaja Empresas delivers a full suite of financial services designed to maintain businesses at every stage. From financing and digital banking to international trade and risk management, Ibercaja provides the tools companies need to proliferate in a in action market.

By partnering taking into account Ibercaja, businesses get admission to adroit advice, protester solutions, and honorable banking services that drive increase and long-term success.

Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Dolly Parton Then & Now!

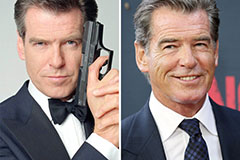

Dolly Parton Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!